Move To Kingsport Monthly Report

January numbers can be deceptive. They’re often the first data point people seize on in a new year, but they’re also the smallest, noisiest slice of the calendar. That’s especially true in housing, where closings reflect decisions made months earlier and where construction timing, weather, and financing cycles all collide. So before drawing big conclusions from January 2026, it’s worth stepping back and looking at the fuller picture.

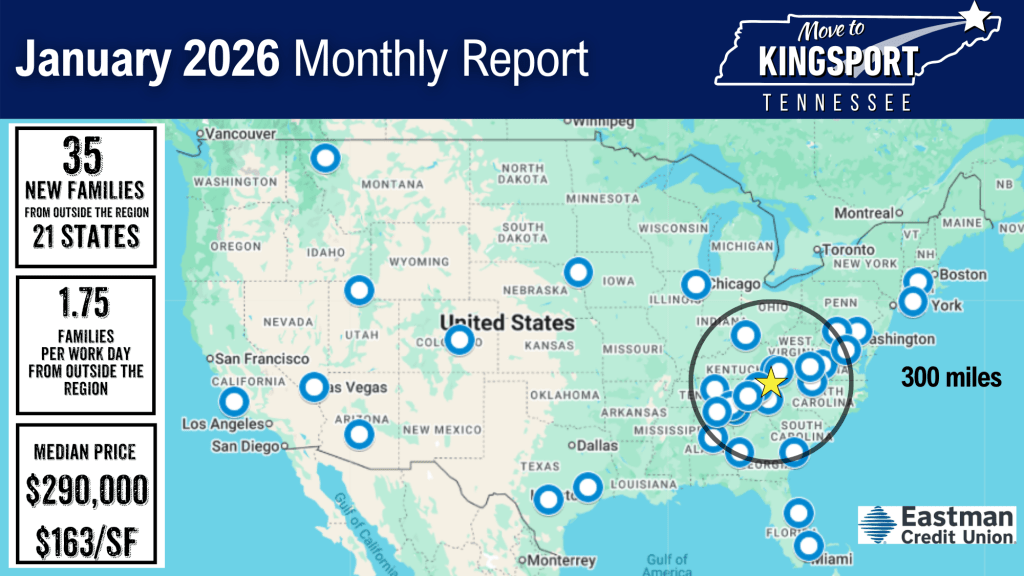

At first glance, January 2026 looks softer than January 2025. The median home price among families moving to Kingsport from outside the region came in at $290,000 this January, compared to $383,000 a year ago. Price per square foot also dipped, from $175 to $163. On the surface, that looks like a pullback.

But the annual data tells a very different—and more accurate—story.

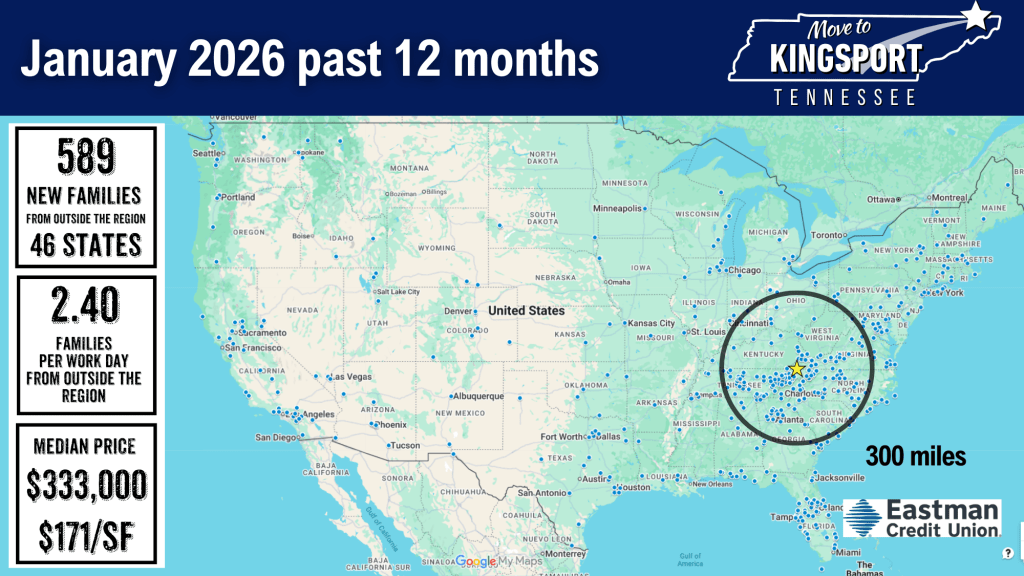

Looking at the past 12 months instead of a single month, the median price is essentially flat: $333,000 for the year ending January 2026, compared to $336,955 the year before. Meanwhile, price per square foot rose from $158 to $171, an increase of roughly eight percent. That’s not a market losing value. That’s a market where what sold changed.

The key shift is composition. Over the past year, fewer new homes have entered the sales mix. New construction peaked locally in 2023 and has gradually eased since then. As a result, more of the homes closing in January 2026 were older and smaller. When that happens, median prices tend to soften even when underlying value—measured per square foot—continues to rise.

That’s exactly what the data shows. January 2026 featured a noticeably older housing stock than recent Januarys, with fewer large, newly built homes closing. The lower median price reflects that mix, not a drop in demand or confidence.

Migration data reinforces that interpretation. Kingsport continues to attract households from across the country. Over the past 12 months, 589 new families moved here from outside the region, representing 46 states. That’s down from 736 families the year before, but context matters. The 2021–2023 period was historically abnormal, driven by pandemic-era remote work, ultra-low interest rates, and sudden geographic flexibility. A 20 percent cooling from those peak years isn’t a reversal—it’s normalization.

What hasn’t changed is the pattern. Most new residents still come from within a 300-mile drive shed, particularly the Southeast and Mid-Atlantic, while a steady stream continues to arrive from higher-cost coastal metros. Kingsport’s appeal remains broad, national, and durable.

In fact, the shift we’re seeing may be a healthy one. Rapid growth often brings volatility: price spikes, infrastructure strain, and affordability pressures. Kingsport’s recent trend is different. Growth has slowed from “too hot” to something closer to “just right.” Prices have stabilized. Value per square foot continues to climb. And the community is absorbing new residents without the whiplash seen in faster-growing markets.

That balance matters. It’s what allows teachers, healthcare workers, young families, and retirees alike to compete in the same housing market. It’s what keeps Kingsport attractive not just to newcomers, but to people who already call it home.

So if January 2026 feels quieter than January 2025, that’s not a warning sign. It’s a reminder that single months don’t define markets—trends do. And the longer trend shows a community that has transitioned from pandemic surge to sustainable momentum, with housing values holding firm and migration continuing at a pace that strengthens rather than overwhelms.

That’s not a slowdown to fear. It’s a course correction many cities would welcome.

Leave a comment