Move To Kingsport Monthly Report

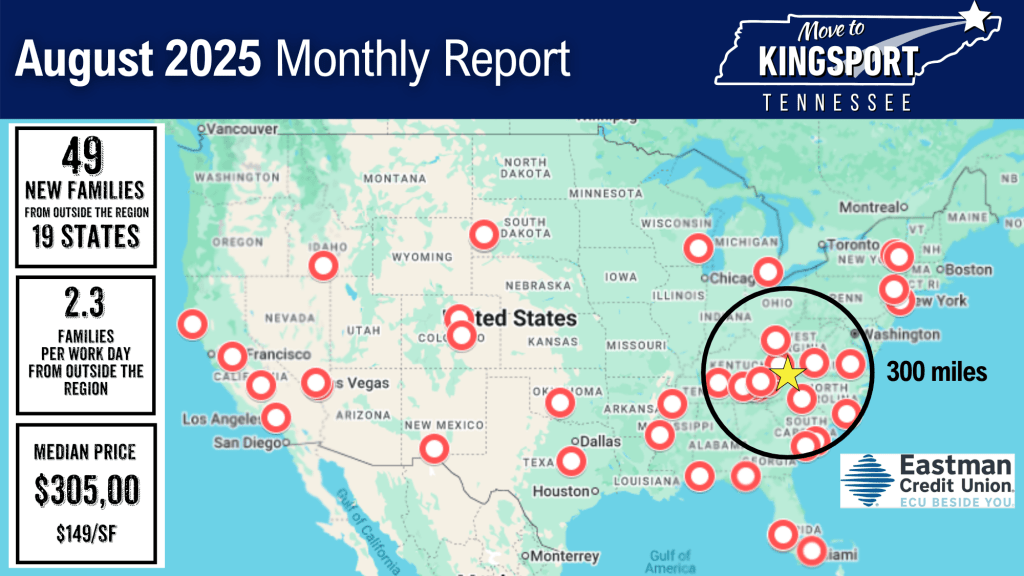

Month-to-month. August 2025 ran cooler than last August. We recorded 49 new families from 19 states, down from 63 families and 26 states in August 2024. The daily pace eased from 2.9 to 2.3 families per workday. Prices also cooled: $305,000 median and $149/SF this August versus $317,005 and $155/SF a year ago. The 300-mile drive market continued to carry the month.

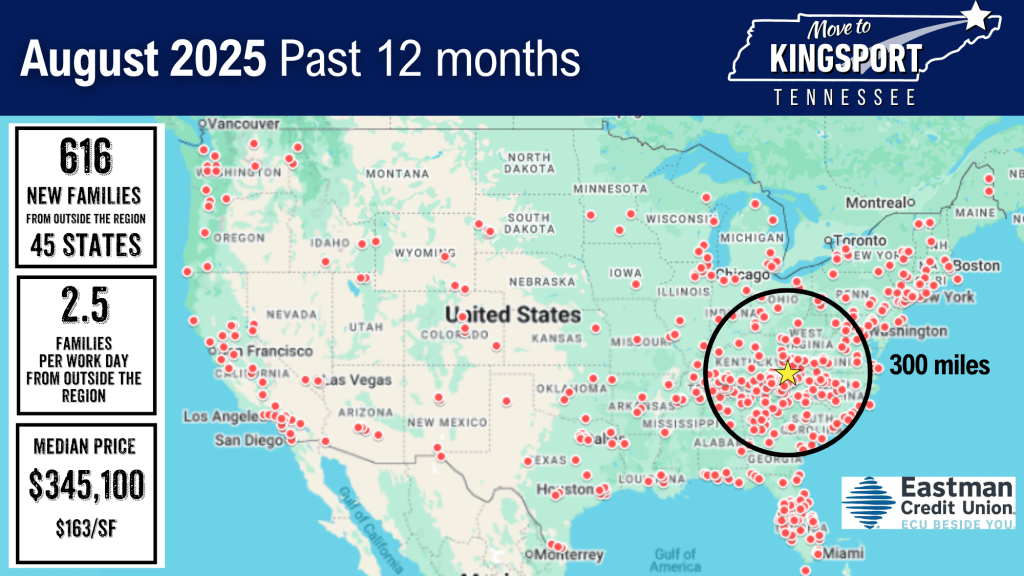

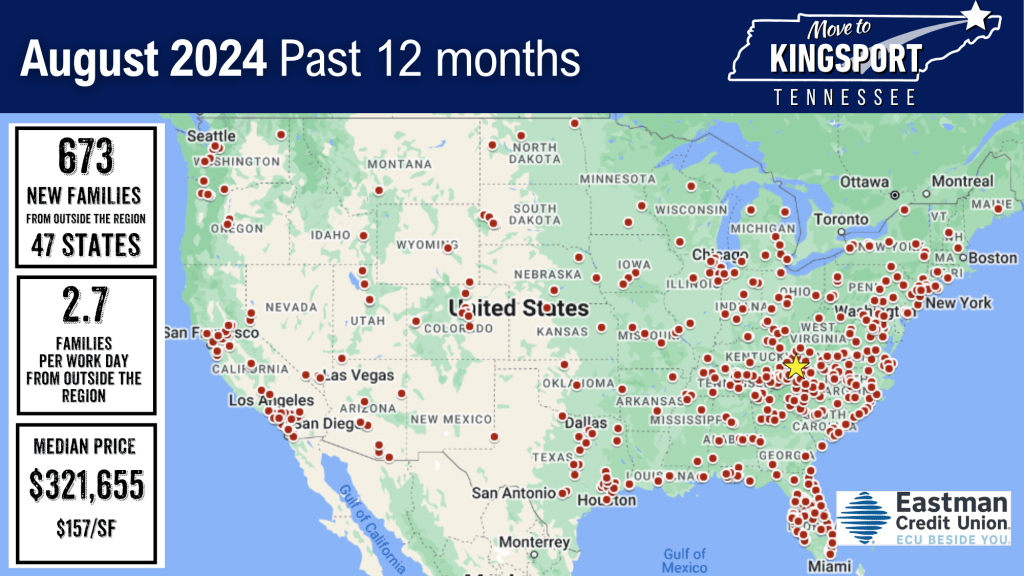

Year-to-year. The twelve months ending August 2025 still show a healthy engine: 616 families from 45 states at 2.5 families per workday. That’s off the prior year’s 673, 47 states, and 2.7, but values ran higher—$345,100 and $163/SF versus $321,655 and $157/SF. One softer month inside a steadier, higher-price year = normalization, not decline.

Where movers came from (last 12 months).

Tennessee (beyond the Tri-Cities): 22% of all movers.

Rest of the South: 47% (Florida, the Carolinas, the Virginias, Texas, Georgia, etc.)

Northeast: 9% (Pennsylvania, New York, New England)

Midwest: 8% (Illinois, Indiana, Michigan, Ohio, Wisconsin, etc.)

West Coast: 7.8% (California, Oregon, Washington)

Mountain & Southwest: 6.5% (Arizona, Colorado, Idaho, Nevada, etc.)

Nearly half (46%) of all moves came from a 300-mile radius in Tennessee, the Carolinas, the Virginias, Kentucky, and Georgia.

The top four states—Tennessee, Florida, North Carolina, and Virginia supply 46% of all newcomers. Again, the Tennessee and Virginia metrics include only those who move from outside the Tri-Cities region.

Florida: our No. 2 pipeline—and why it slowed

Florida delivered 12% of all movers (76 families) in the last year, making it our second-largest source. But that pipeline slowed sharply in 2025 as Florida’s housing market cooled. The cause-and-effect is direct: if you can’t sell there, you can’t move here.

What changed in Florida?

Insurance shocks and underwriting tightness. Homeowners’ premiums—especially for wind and flood—jumped again in many counties. Some carriers tightened guidelines. Higher carrying costs shrink buyer pools and slow closings.

Fees and assessments. Rising HOA/condo fees and post-Surfside building standards raised monthly costs in parts of the state, making buyers more cautious.

Rates and affordability. Mortgage-rate volatility in 2025 collided with already high prices in popular metros (Tampa Bay, Orlando, Southwest Florida), lengthening days-on-market and increasing price cuts.

Storm and climate risk. Each active storm season adds uncertainty for buyers, lenders, and insurers and can delay closings.

Conclusion

August was a cooler month, but the year still looks solid. Prices are higher than last year on a 12-month basis, and our reach remains broad—especially within a 300-mile drive where nearly half of our movers originate. The main swing factor is Florida. As its housing market slowed under the weight of insurance costs, higher fees, and rate pressure, our inflow from the Sunshine State eased, and our August total followed suit. The rule still applies: if you can’t sell there, you can’t move here.

Leave a comment