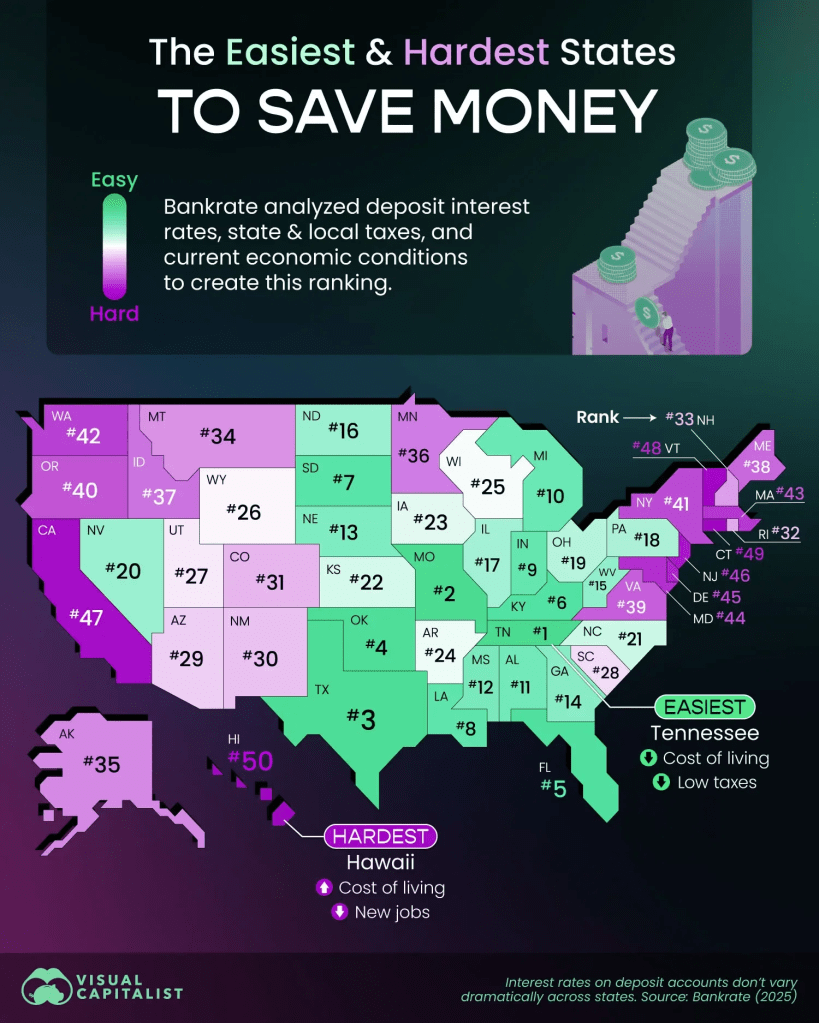

Bankrate’s new 2025 study on the best and worst states for saving money confirms what many of us already sense: where you live can make or break your ability to build a cushion. Tennessee ranked #1 in the nation, thanks to low taxes and a cost of living that still beats the national average. That isn’t just a statewide statistic—it’s a reality we see every day here in Kingsport.

Our community benefits from the same formula driving Tennessee’s top spot: affordable housing, no state income tax, and an economy that continues to diversify. Those factors combine to give families, retirees, and young professionals a chance to save instead of constantly scrambling to cover the basics. Compare that with places like New York (#41), New Jersey (#46), and California (#47), where high costs and heavy taxes make it nearly impossible to get ahead, and you begin to see why people are drawn to communities like ours.

Other states tell an interesting story. Florida (#5) and Texas (#3) also rank among the easiest places to save, fueled by no income taxes and strong economic growth. Yet in both states, housing affordability is slipping fast with rising coastal insurance costs and independent school district taxes quickly eroding some of the savings’ advantage. Colorado (#31), Oregon (#40) and Washington (#42), meanwhile, face a different challenge. These regions often boast higher wages, but sky-high housing costs and growing tax burdens drain away the benefit.

Closer to home, East Tennessee is far ahead of its neighbors when it comes to saving money. Virginia (#39) is weighed down by a progressive income tax and the second highest car tax in the nation. North Carolina (#21) and South Carolina (#28) fall in the middle of the pack, both challenged by income taxes and rising housing costs in fast-growing metros. Georgia (#14) still trails Tennessee by a wide margin due to Atlanta-driven living expenses and its state income tax.

What sets Tennessee apart is the combination of affordable housing, steady economic growth, and no state income tax—factors that make an ordinary paycheck go further. For families in Kingsport and across East Tennessee, that translates into something tangible: more breathing room to save and a stronger shot at financial security than most of our regional neighbors can offer.

I speak with students and newcomers all the time, explaining that where you live has a big bearing on how you succeed financially. With all the headwinds coming at you—student loan debt, mortgage downpayments, and the rising cost of essentials—it pays to be fiscally aware. A nurse or teacher starting out in Kingsport can realistically buy a home and build savings on the same salary that leaves a counterpart in Atlanta or Charlotte struggling to get ahead.

But here’s the hard truth: just because Tennessee makes it possible for families to save doesn’t mean they actually take advantage of it. It’s human nature to spend when you could be saving and investing. Savvy consumers won’t squander the opportunity. Kingsport’s combination of affordability and opportunity gives people a fighting chance—but whether they seize it is ultimately up to them.

Choose wisely.

Leave a comment