MoveToKingsport.com Monthly Report, July 2025

Kingsport’s relocation story this July is one of moderation—a gentle easing after two break-neck years of growth. Compare the present to last summer and three plotlines emerge: a slight taper in the raw number of newcomers, a persistent upward drift in long-run home prices, and a subtle reshaping of where those newcomers are coming from. Taken together, they point to a market that is maturing, not stalling.

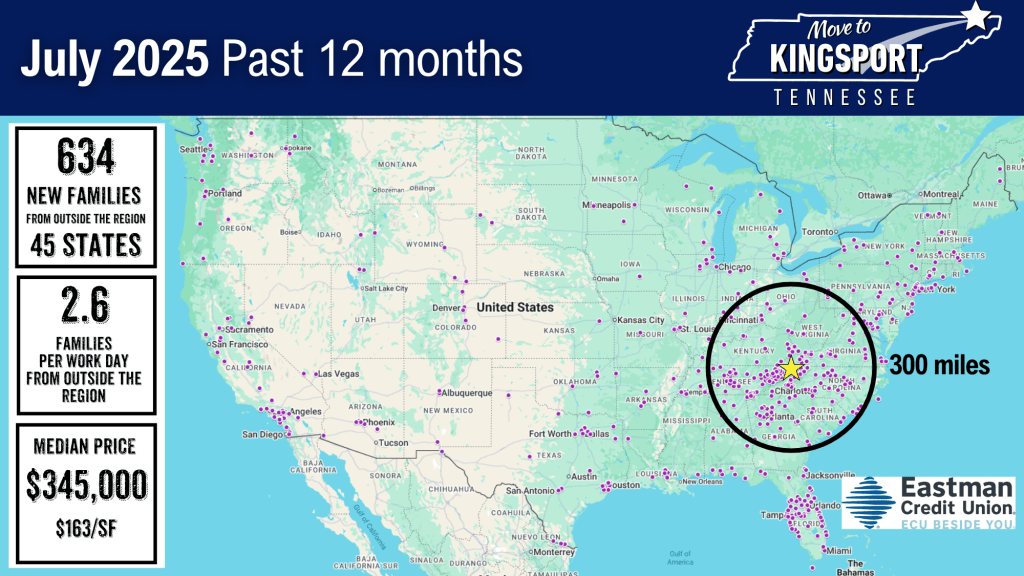

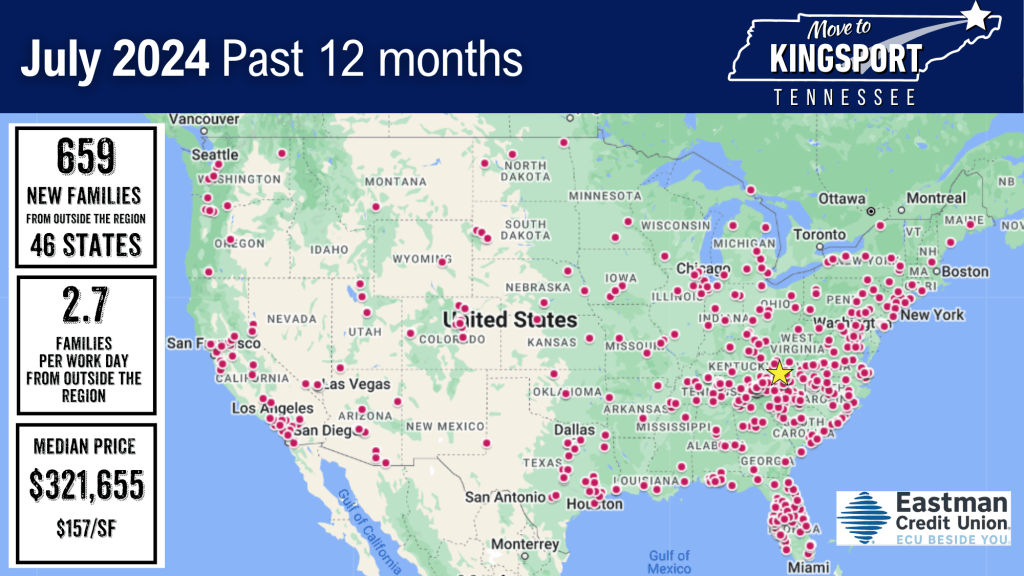

Over the trailing twelve months, Kingsport welcomed 634 families from outside the region, just twenty-five fewer than the 659 recorded a year ago. That three-percent dip translates to 2.6 relocating households per workday, down a mere tenth from last year’s rate. In other words, the pipeline is still pumping at almost the same volume; it has simply settled off its pandemic-era crest. Yet during the same span the median sales price marched from $321,655 to $345,000, and the price per square foot nudged up from $157 to $163. Fewer arrivals, higher prices—classic evidence that supply remains tight and that even modest demand can keep sellers firmly in the driver’s seat.

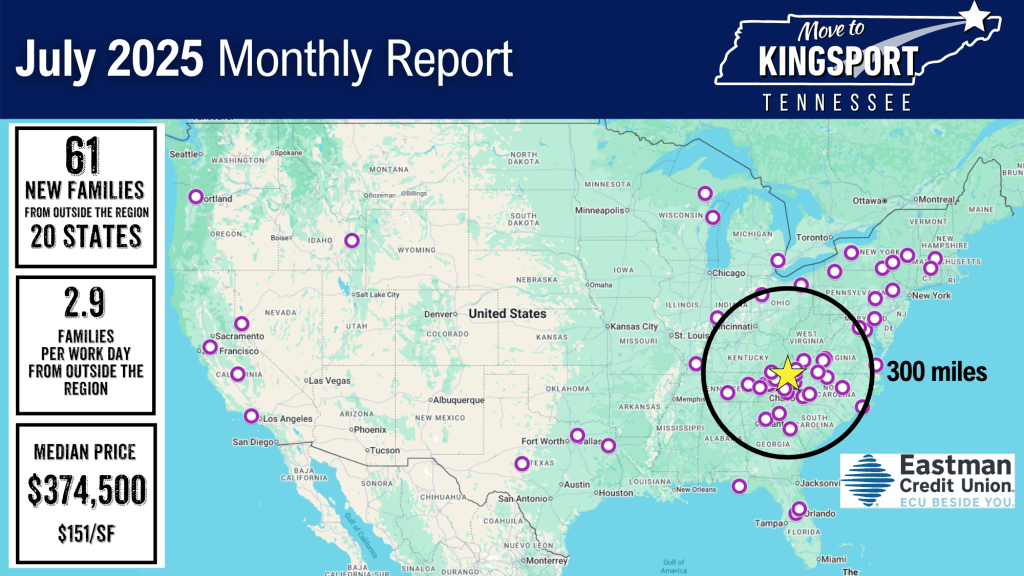

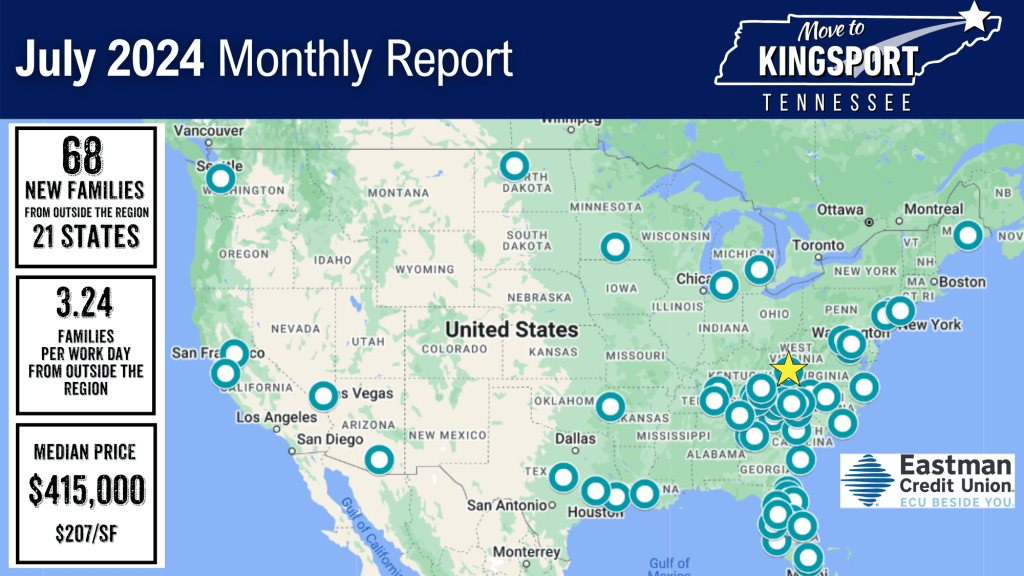

July’s single-month snapshot adds nuance. Sixty-one out-of-area families closed on homes this July, seven fewer than the sixty-eight who arrived last July. The July-only median slid from $415,000 to $374,500, and the median price per square foot dropped sharply, from $207 to $151. That swing is less an omen of collapsing values than a shift in the mix of homes sold.

Maps of origin points reinforce that interpretation. In 2024 the scatter of pins was truly continental, sprinkled from the Pacific Northwest to Miami and Boston. Those long-haul moves still appear on this year’s map, but the densest cluster now lies inside a 300-mile radius of Kingsport—including Knoxville, Asheville, Roanoke, Charlotte, and the Piedmont Triad. The city is still a national draw (forty-five states sent newcomers in the past year), yet proportionally more buyers can scout the market in a weekend’s drive and haul a moving truck without crossing time zones. Fewer coastal “equity migrants” naturally tilt the price mix toward the middle.

What does this mean for the months ahead? First, demand remains resilient. A three-to-four-percent slowdown is barely a blip compared with the surge Kingsport experienced in 2021–24. Second, pricing power persists over any period longer than a single month; tightening inventory continues to buoy values. Third, episodes of improved affordability will surface when the transaction mix leans toward mid-scale homes—opportunities that attentive buyers can seize. Finally, the evolving geography of in-migration suggests that targeted marketing in nearby metros—where a weekend visit is feasible—may now yield the greatest return.

In short, Kingsport’s in-migration engine has throttled back from redline to a strong cruise, but it is still propelling the housing market forward. A community that can use this breathing room to add inventory while safeguarding quality of life will be well positioned when the next surge comes calling.

Leave a comment