We recently participated in the annual Ideal Living show in partnership with Retire Tennessee. Each year, local chambers of commerce and tourism organizations collaborate to answer questions at this bustling event, where attendees explore relocation options. This past weekend, we were in Greater New York (Long Island). Over the next few weeks, we’ll visit New England (Greenwich, CT), Greater New Jersey (Bridgewater), Greater Philadelphia (Valley Forge), and Greater DC (Tyson’s Corner).

Ideal Living caters to high-net-worth households with the means and motivation to relocate. They provide participants with a detailed guide and workbook to plan their move—whether it’s to coastal Carolina, Georgia, or Florida, or the scenic hills and mountains of Tennessee, Georgia, or North Carolina. Recently, they’ve even added international destinations to the mix.

When we first started participating years ago, Tennessee struggled to gain traction. Many attendees viewed it as a landlocked state lacking the amenities they deemed essential. However, perceptions have shifted dramatically over time. These days, our booth is buzzing from start to finish, with barely a moment to pause.

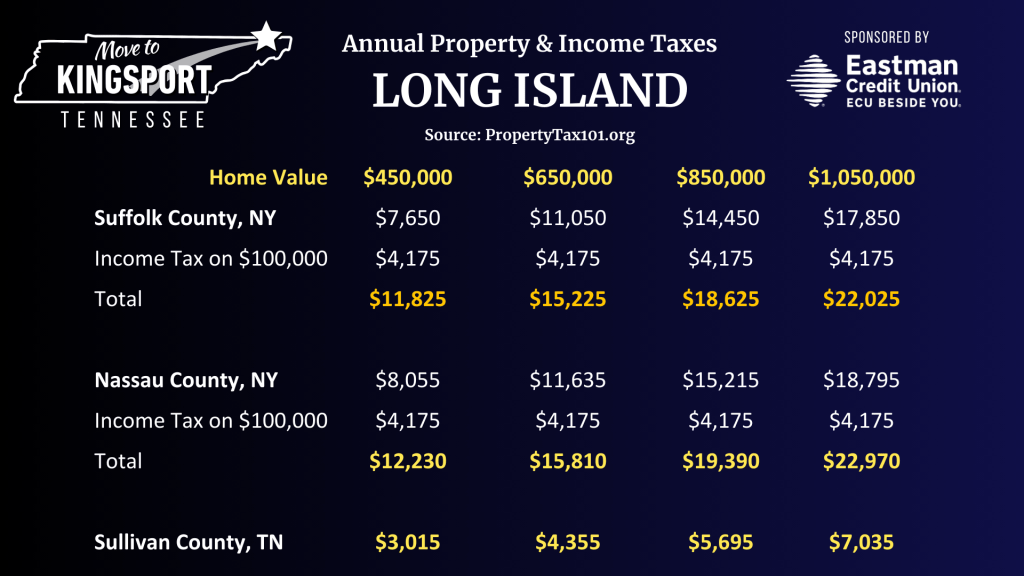

A key driver of this shift is their growing concern about climate change, natural hazards, and the rising costs of coastal living. Understandably, these individuals have spent their entire lives within a short drive of the ocean, but they’re now amazed to discover the exceptional quality of life Tennessee offers—complete with low taxes and robust amenities.

As they learn more, many express frustration with the narrative they’ve long been told: that higher taxes guarantee a higher quality of life. For those whose mortgages are paid off, mounting property taxes are cutting into their retirement savings, leaving less money for the travel and experiences they had envisioned.

Another common misconception is the need for proximity to major international airports like LaGuardia, JFK, or Newark. Once they discover the convenience of regional airports like TRI, they realize that a simpler, more accessible alternative might suit them just as well.

It’s no secret that Tennessee’s cost of living is significantly lower, even before factoring in taxes. But listening to these stories reminds us to reflect on how impactful this difference truly is. Tennessee isn’t just less taxing financially—it’s less taxing personally.

Every time I leave an Ideal Living show, I feel even more blessed to call Tennessee home. If others could be a fly on the wall for these conversations, I think they’d gain a newfound appreciation for just how fortunate we are to live here.

Leave a comment