In assessing local prosperity, it’s tempting to focus on headline wage figures: “Knoxville pays $31 per hour,” or “Johnson City surged to $30.” But for Kingsport—a city long celebrated for its measured growth and community spirit—the real story lies in how those paychecks go further against local costs. By blending respectable nominal wage gains with one of the region’s most affordable price tags, Kingsport offers a case study in balanced economic health.

Steady Earnings Growth

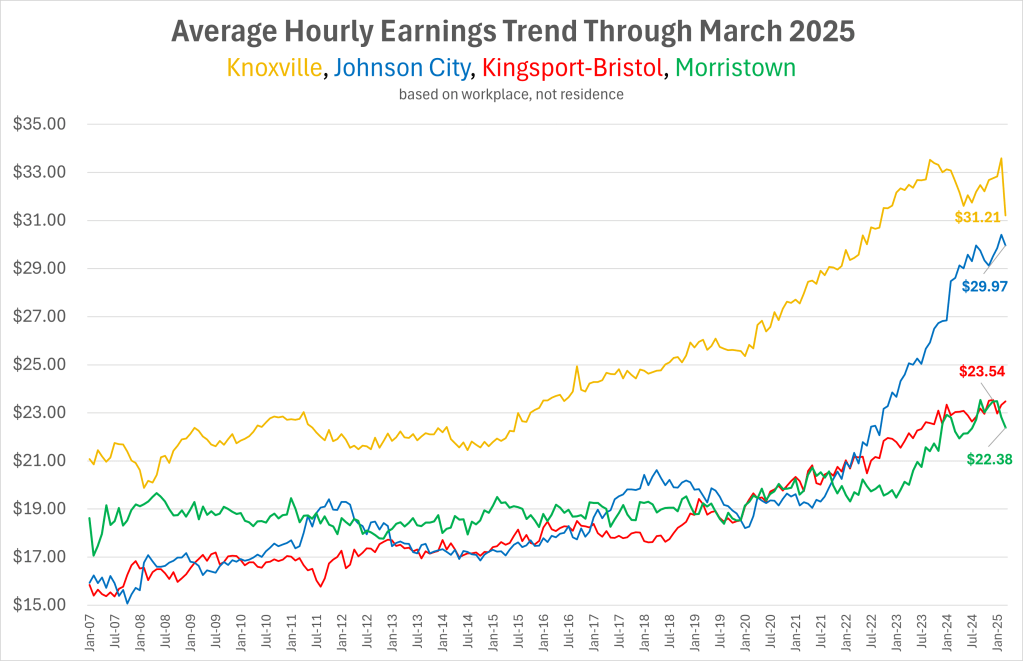

Since January 2007, Kingsport-Bristol’s average hourly earnings climbed from roughly $16 to $23.50 by March 2025—a 47 percent increase. That pace trails Knoxville’s 57 percent jump and Johnson City’s post-2020, 60 percent leap; yet it comfortably outpaces Morristown’s more modest 18 percent rise. The difference? Kingsport’s employers—rooted in manufacturing, healthcare, and logistics—have boosted wages in response to tight labor markets without triggering runaway inflation in local business costs.

Affordability as a Multiplier

Where Kingsport truly shines is cost of living. Kingsport’s housing index remains some 25–30 percent below Knoxville’s baseline. Utility rates, fees, and taxes are among the region’s lightest. Taken together, a $23.50 hourly wage here buys the same standard of living that might demand $28–$30 in Knoxville or Johnson City. In other words, Kingsport’s real wages—earnings adjusted by local price levels—rank among the highest in East Tennessee.

Comparing Real Purchasing Power

- Housing: A three-bedroom rental in Kingsport averages $1,100 per month versus $1,400 in Johnson City and $1,500 in Knoxville. That $300–$400 gap translates into an extra $2–$3 per hour in disposable income for a full-time worker.

- Utilities & Taxes: Modest rates for water, sewer, and electricity save residents the equivalent of $1–$2 per hour compared to neighboring metros.

- Everyday Expenses: Groceries, transportation, and healthcare in Kingsport run 5–10 percent below regional averages, further stretching take-home pay.

Why Kingsport’s Balance Matters

Economic development thrives on equilibrium: competitive wages attract talent, while reasonable costs retain it. Kingsport’s model—wage growth tempered by affordability—helps avoid the boom-and-bust cycles seen in high-cost metros. For families, that means predictable budgets; for businesses, a stable workforce and lower turnover; and for local government, steady property-tax revenues without the social strains of rapid gentrification or declining real incomes.

Lessons for Policy and Planning

- Track Real Wages, Not Just Nominal Rates. Policies aimed solely at boosting average earnings risk overlooking how far those dollars stretch in local markets.

- Preserve Affordable Housing. Continued investment in mixed-income neighborhoods ensures that wage gains translate into improved living standards, not just higher rents.

- Leverage Cost Advantages. Kingsport’s affordability can be a marketing asset to recruit remote workers and employers that weigh total compensation packages, not just salary figures.

Conclusion

Kingsport’s journey from a $16 to $23.50 average hourly wage underscores a broader truth: prosperity is best measured by what your dollars buy, not just how many you earn. By pairing solid wage growth with one of the lowest cost-of-living profiles in East Tennessee, Kingsport stands out as a place where paychecks stretch further—and where thoughtful, steady growth creates lasting opportunities for everyone.

Leave a comment