As you likely know, I’ve been involved with Move To Kingsport for 25 years. Upon retirement 5 years ago, I began managing the program on a part-time basis for Visit Kingsport. Marketing my hometown has become part of my psyche, so I thought I’d share some insights we are asked by new citizens and those researching our town.

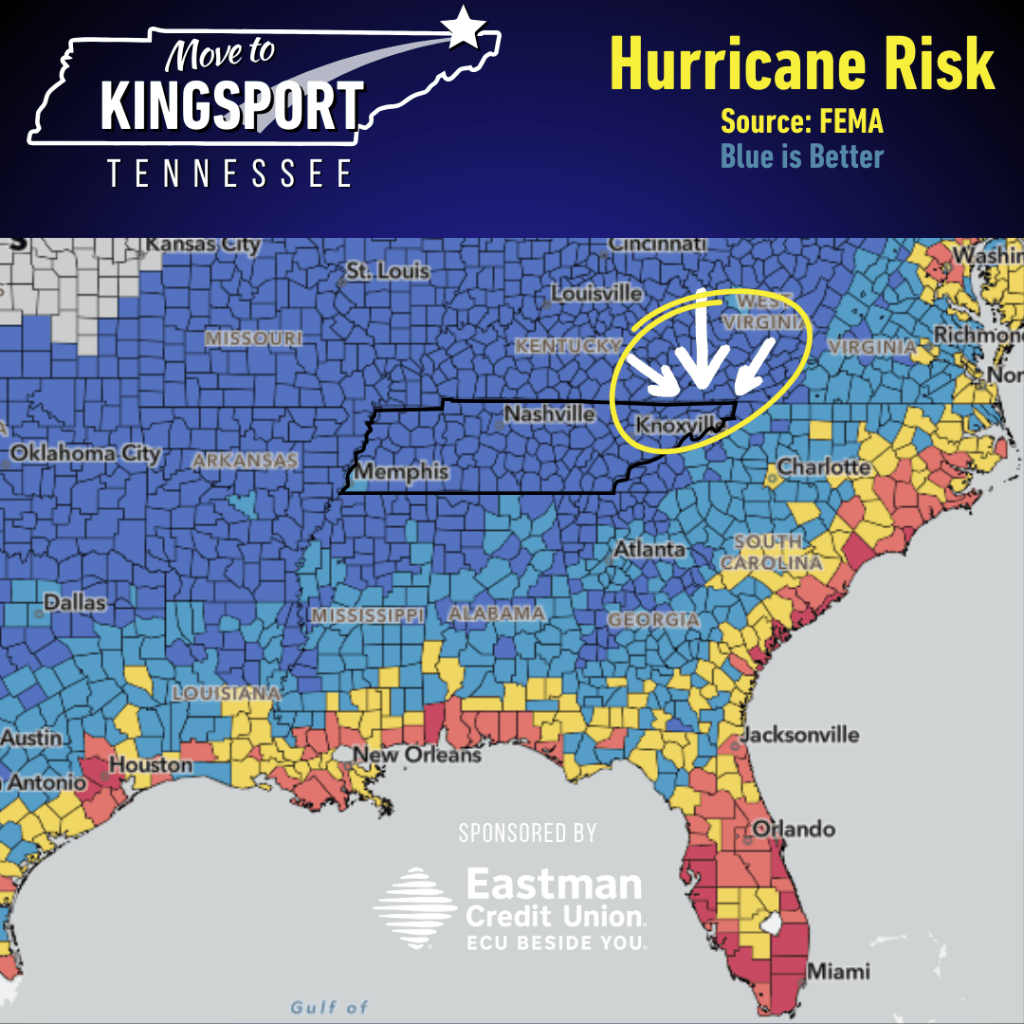

We don’t usually talk about this during hurricane season—on purpose. But hurricanes significantly impact the cost of living.

Coastal living has its perks: sunny skies, ocean views, and a laid-back vibe. But the charm fades when storm clouds roll in. Between 2020 and 2023, insurance premiums rose 13% nationwide in real terms. However, areas exposed to climate risks saw much steeper increases.

Florida experienced some of the sharpest home insurance hikes last year, driven by excessive litigation, widespread fraud, and the growing threat of natural disasters. In 2023, Florida homeowners paid an average annual premium of $𝟭𝟬,𝟵𝟵𝟲—the highest in the nation—compared to the national average of $𝟮,𝟯𝟳𝟳. Insurify projects that this figure will climb even higher, reaching $11,759 by the end of 2024.

These rising costs burden property owners, whether added to mortgage payments, HOA fees, or paid out-of-pocket. Many find the costs unsustainable, and an increasing number of Floridians are choosing to “go bare,” skipping home insurance altogether and opting to self-insure. Experts warn that this trend carries significant risks.

Even if you live inland, hours from the coast, you’re at higher risk of residual storms.

Northeast Tennessee provides a natural shield from extreme weather, and the difference shows in its insurance costs. For those seeking stability and affordability, this region offers a compelling alternative.

𝘚𝘰𝘶𝘳𝘤𝘦: 𝘕𝘢𝘵𝘪𝘰𝘯𝘢𝘭 𝘉𝘶𝘳𝘦𝘢𝘶 𝘰𝘧 𝘌𝘤𝘰𝘯𝘰𝘮𝘪𝘤 𝘙𝘦𝘴𝘦𝘢𝘳𝘤𝘩

Leave a comment